Blog post

Introducing KYC Insights

Naftali Harris

Published

October 20, 2021

Hi friends,

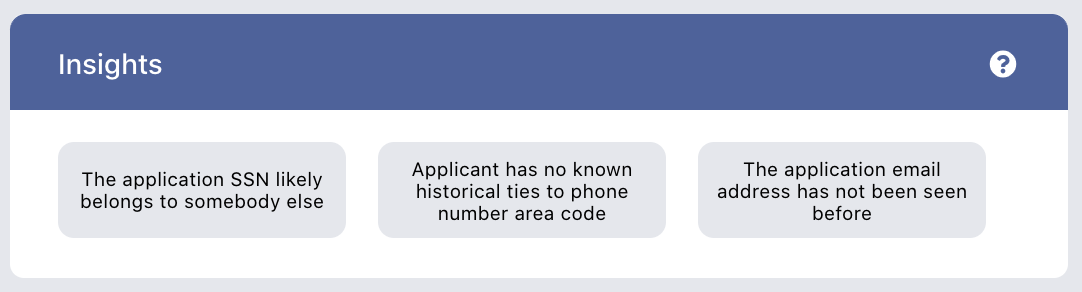

All of us at SentiLink are proud to announce the release of our new KYC Insights product! KYC Insights flags suspicious issues associated with applications for financial products, checks for PEPs and sanctions, and helps you to satisfy your KYC obligations. It looks like this (also available via API):

We built this by taking a first principals approach to the CIP rules, which require each bank to "form a reasonable belief that it knows the true identity of each customer." This contrasts to legacy KYC "solutions," which instead essentially check whether the applicant name, DOB, SSN, and address match credit header data, and end up "verifying" synthetic and stolen identities. Our KYC Insights solution surfaces over 50 different insights about applications ranging from benign ("first name appears typoed") to highly suspicious (like the insights in the screenshot above).

If you're interested in learning more, why not reach out and book a demo?

Related Content

.png)

Blog article

February 20, 2026

Romance Fraudsters Have Found a New Target: Your Home Equity

Read article

Blog article

February 19, 2026

Introducing SentiLink Intercept: Precision Tools for High Stakes Fraud Decisions

Read article

Blog article

December 2, 2025